View Of Ethereum As Money: How Stablecoins Are Related?

4 min

Even though Ethereum coins, or as they are commonly called ETH, has a good claim to become money, stablecoins might become a rival to ETH. It might be a weird thing to say since the increased popularity of stablecoins is good for ETH. But some experts claim it might have some downsides.

Currently the market of exchanging stablecoins is at its highest and most would think that it is good for ETH since the more people use stablecoins, the more they need ETH. But this is not exactly the full picture. As it is reported, stablecoins market is estimated at 3 billion dollars. And at the same time the transfer of stablecoins needs the Ethereum platform. Meaning, that growth of stablecoins means the grows of using ETH.

But is it good? The truth is that there are advantages and disadvantages of this process.

Advantages Of Stablecoins Growth For Ethereum

Since stablecoins are used more and more these days, it means that the need for stablecoins is growing. Which will inevitably lead to the need for Ethereum since any stablecoin transaction needs ETH for fees transaction.

The fact that stablecoins are becoming more popular as tokens for the crypto world has lead to the situation where thousands of projects based on stablecoins have been already launched. Most of these projects are created on the basis of ERC-20 tokens - tokens created by the Ethereum.

As a result, thousands of projects that are using ERC-20 standard have a chance to make ERC-20 one of the most competitive tokens - if not the most competitive token. It would be extremely difficult for other standards to compete with ERC-20 which is technically a good thing for Ethereum since it inevitably leads to a bigger need of ETH. But everything might not be as good as it seems to be.

Disadvantages Of Stablecoins Growth For Ethereum

As stablecoins could technically increase the need of ETH, it could as well lower its premium. It might happen since there are many signs for it to become an issue. Since stablecoins are used more often and the usage of stablecouns is even growing more and more each day, ETH might be questioned as money in the world of cryptocurrency.

Stablecoins were created to lower the volatility of cryptocurrency which means they might become medium of exchange or even the main unit for transactions and smart contracts. Since USDC (a stablecoin) now might be used as a collateral on Dai platform, this is already happening, ETH is questioned as money. For now, this rapid growth of stablecoins usage is a good thing for Ethereum, but will it be good in the long run?

Most experts agree upon the fact that in the long run, this rapid growth of stablecoins usage is a huge threat for ETH. Even though now the demand for ETH is increased, later on users might start questioning the need of ETH while they proceed using stablecoins.

In order for ETH to be competitive on the market, to keep its need among users of cryptocurrency, Ethereum should focus not on increasing the demand for ETH coins, they should go the other way. For instance, most experts also agree that the need for ETH as of a collateral might have a great positive impact on Ethereum overall.

It should also be noted that the stablecoins have grown in capitalization during this month by 1 billion. In less than a month, the market capitalization has grown from 4.4 to 5.14 billion. Moreover, most of this growth is coming from stablecoin Tether (on Ethereum). So it might inevitably lead to a bigger demand of stablecoins, not of ETH.

Currently this growth leads to positive effects on Ethereum, but eventually, it might become a huge downside for ETH. Since stablecoin transaction are even more popular than Bitcoin and Eth transactions, in a long run this situation might damage ETH.

Where To Learn The News?

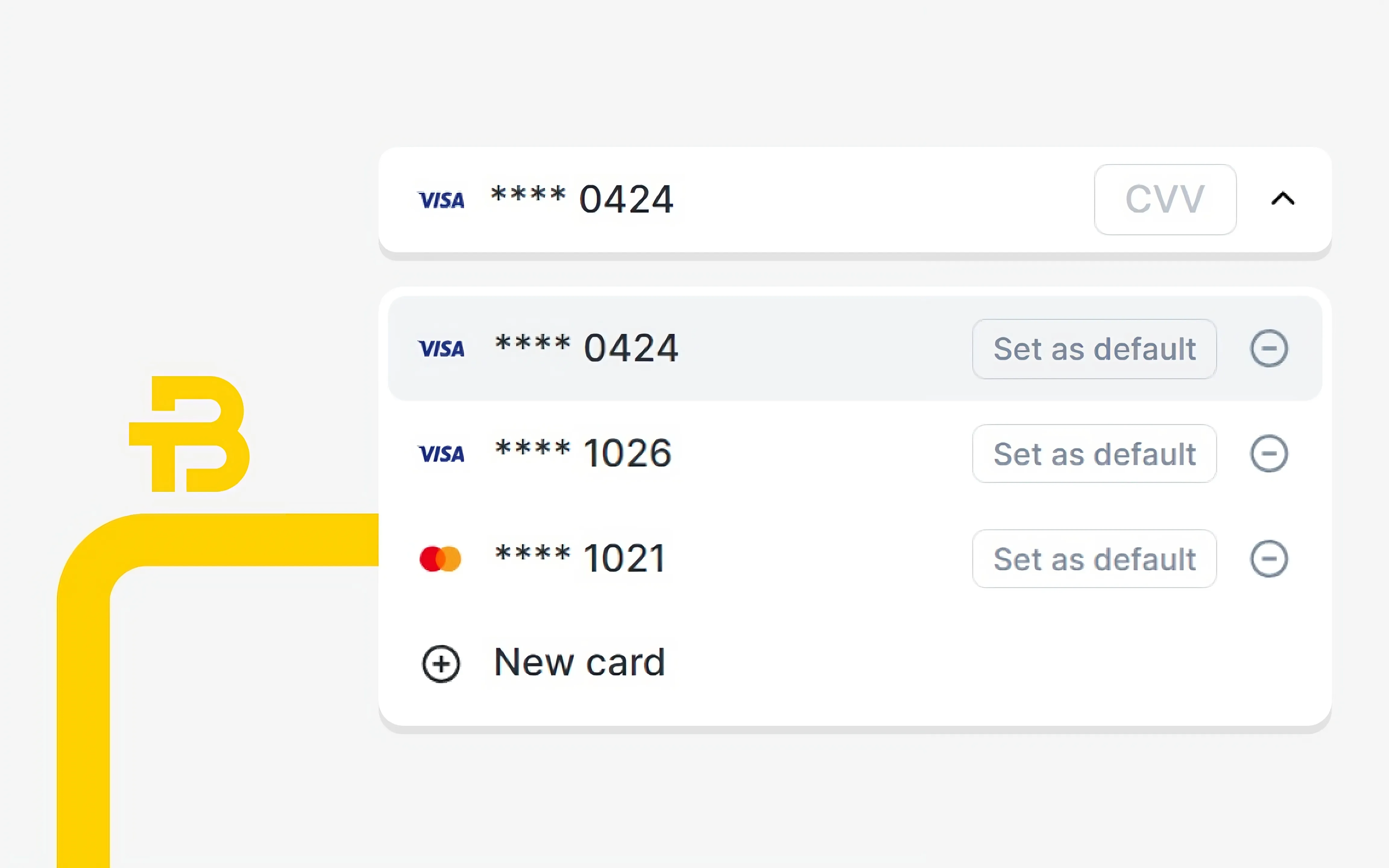

If you are trying to keep up with the rapidly changing situation in the cryptocurrency world, you can check out BTCBIT.NET platform. It provides users with the exchange services as well as with the information about the current situation on the market. You can safely complete the exchange, as well as to keep up with the situation.

Conclusion

Right now the popularity of using stablecoins is a good thing for ETH. But only for now since in the long run the need of ETH might be questioned. Since some stablecoins are already used as collateral, it might damage ETH. Experts claim that Ethereum needs to increase the demand for the so called trust minimized applications which will use ETH as collateral, and not stablecoins.

Other news

More newsOne Single Step

Learn more