∙ Blockchain News

ICONLOOP and SBI Savings Bank Use Blockchain for Authentication

1 min

South Korea’s premier blockchain company on Monday announced a collaboration with one of the region’s largest banks that will work to apply the technology to making personal authentication services more secure.

In a world increasingly plagued by cybercrime and personal identity theft, digital authentication has become a key element of online security, especially when it comes to banking. Seoul headquartered SBI Savings Bank has launched the country’s first blockchain-based authentication service powered by technology from South Korea-based blockchain developer ICONLOOP.

The company is also behind the ICON blockchain platform. ICON says it has signed more than 100 business partnerships with major South Korean industrial and financial companies in the last year alone.

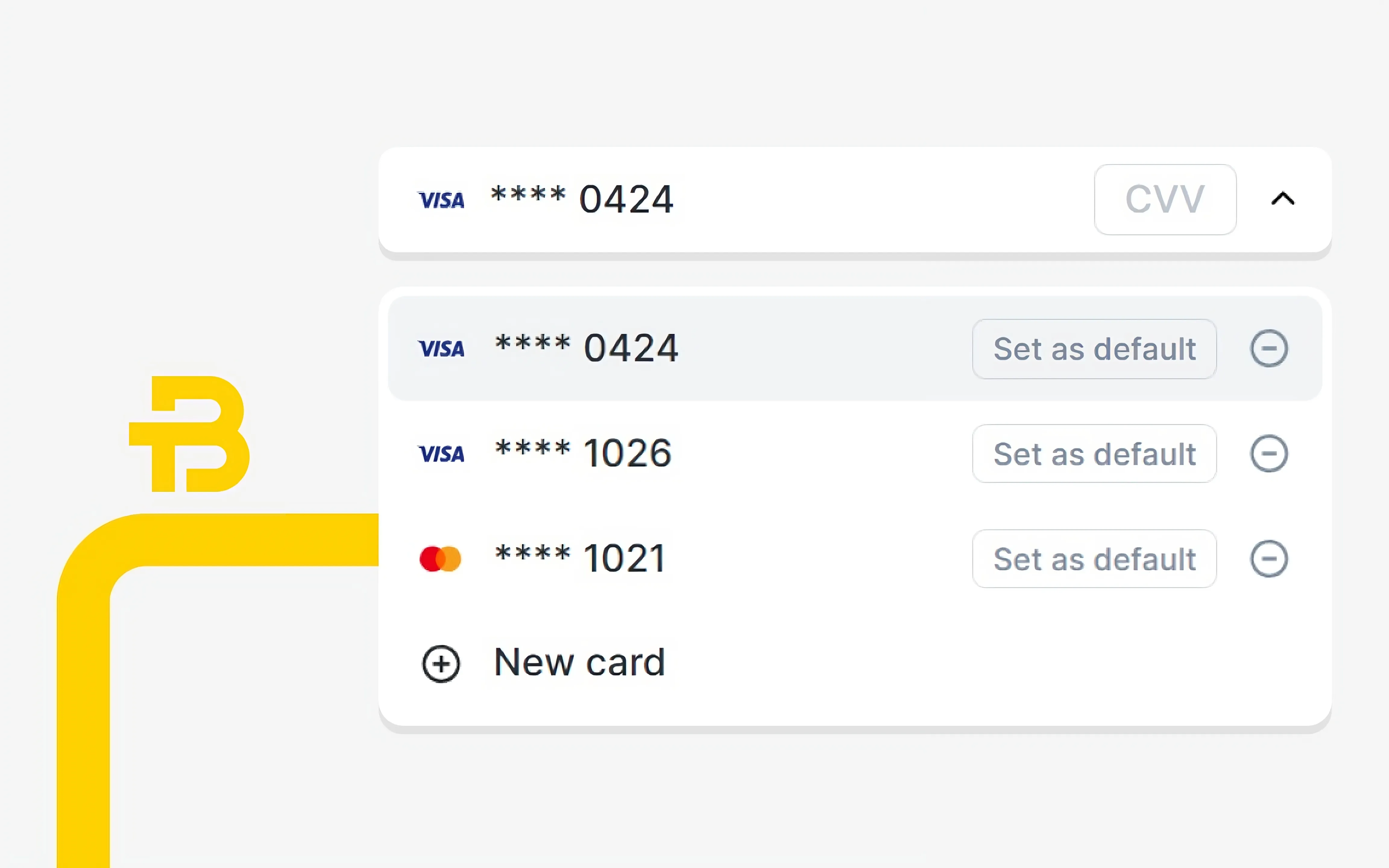

ICONLOOP says its ‘SBI Simple Authentication’ will work via SBI Savings Bank’s mobile banking apps and will enable users to verify blockchain-based PIN or fingerprint access without the need for further security steps, such as one time passwords (OTP) or security cards.

A smart contract environment called SCORE, that has also been developed by ICONLOOP, will be used to authenticate the integrity of the data. This, says ICONLOOP, will simplify the process as it eliminates the need of third-party certification authorities.

In a world increasingly plagued by cybercrime and personal identity theft, digital authentication has become a key element of online security, especially when it comes to banking. Seoul headquartered SBI Savings Bank has launched the country’s first blockchain-based authentication service powered by technology from South Korea-based blockchain developer ICONLOOP.

The company is also behind the ICON blockchain platform. ICON says it has signed more than 100 business partnerships with major South Korean industrial and financial companies in the last year alone.

ICONLOOP says its ‘SBI Simple Authentication’ will work via SBI Savings Bank’s mobile banking apps and will enable users to verify blockchain-based PIN or fingerprint access without the need for further security steps, such as one time passwords (OTP) or security cards.

A smart contract environment called SCORE, that has also been developed by ICONLOOP, will be used to authenticate the integrity of the data. This, says ICONLOOP, will simplify the process as it eliminates the need of third-party certification authorities.

Other news

More newsOne Single Step

Learn more

Registration

You only need to enter your email and password, no additional data. Instant registration.

**********