Wallets of the Future: Are Crypto Wallets Safe Enough

5 минуты

Physical money is slowly and surely becoming a thing of the past. It’s hard to say for sure right now if there will ever come a time where it’s gone completely, but it won’t be long before it ceases to be such a widespread payment method.

Even right now, basically everybody has a debit card or a credit card, or both and that’s been something that has slowly become the norm over the last several decades. Even cheques, the original alternative to paper and coins have started to become somewhat obsolete.

Nowadays, things are even going a step further than that. If you’re on this site you’ve probably heard about cryptocurrency, most everyone has, it’s the next major step in the evolution of money and how we spend.

Cryptocurrency is pretty new. The prospect of an online currency with ledgers secured by encryption wasn’t something that was even considered until around 1998 and it wasn’t something that was successfully established until Bitcoin came along in 2009.

By this stage you’re probably well aware of how it works. The notion of a blockchain, with each of the blocks holding the individual transaction information. For you to use it for your own personal transactions, what you need is a crypto wallet.

This is basically something that contains a piece of software which will enable you to send and receive cryptocurrency. The software is connected directly to the blockchain but the wallet is what generates your private and public keys.

The private key is known only to you and your wallet but it has a corresponding public key which allows you to spend your cryptocurrency. So without one of these you don’t really have a way to store any Bitcoin or alternative currency.

But like with a regular wallet, you have to think about security. The system is new enough which means it's not entirely regulated yet so things like hacking and theft of funds are not entirely uncommon.

And if something gets corrupted and you lose your funds as a result, there isn’t really anything that you can do to get them back. There are a couple of different kinds of crypto wallet, each of which has their own advantages when it comes to security, so let’s have a look at them:

Hardware Wallet

You can store your currency on a piece of hardware such as a USB drive that you can then carry around and keep on your person at all times. This is one of the types that would be classified as cold storage.

What this means is that it’s not connected to the internet until you actually make the transaction. It’s kind of like having a wallet filled with cash in that regard which makes it basically impossible to hack.

You have all the control if your cryptocurrency is stored on a piece of hardware. What it also means however, is that if you lose it, then there’s no backup. In the same vein, if the hardware gets corrupted you don’t have a record of it online.

Desktop Wallet

This is another type of cold storage because it’s also one that’s not directly connected to the internet. You would be able to access this one exclusively through your own personal and private computer.

The advantage to this one of course is similar to the hardware wallet in the sense that the likelihood of hacking is dramatically reduced and it also has an advantage over the hardware in that you are much less likely to misplace a computer than a USB stick.

Still though, computers can get infected with malware which is specifically designed to root out crypto wallets. This is a process known as cryptojacking, and if you’re going the desktop wallet route you need to be aware of it.

Web Wallet

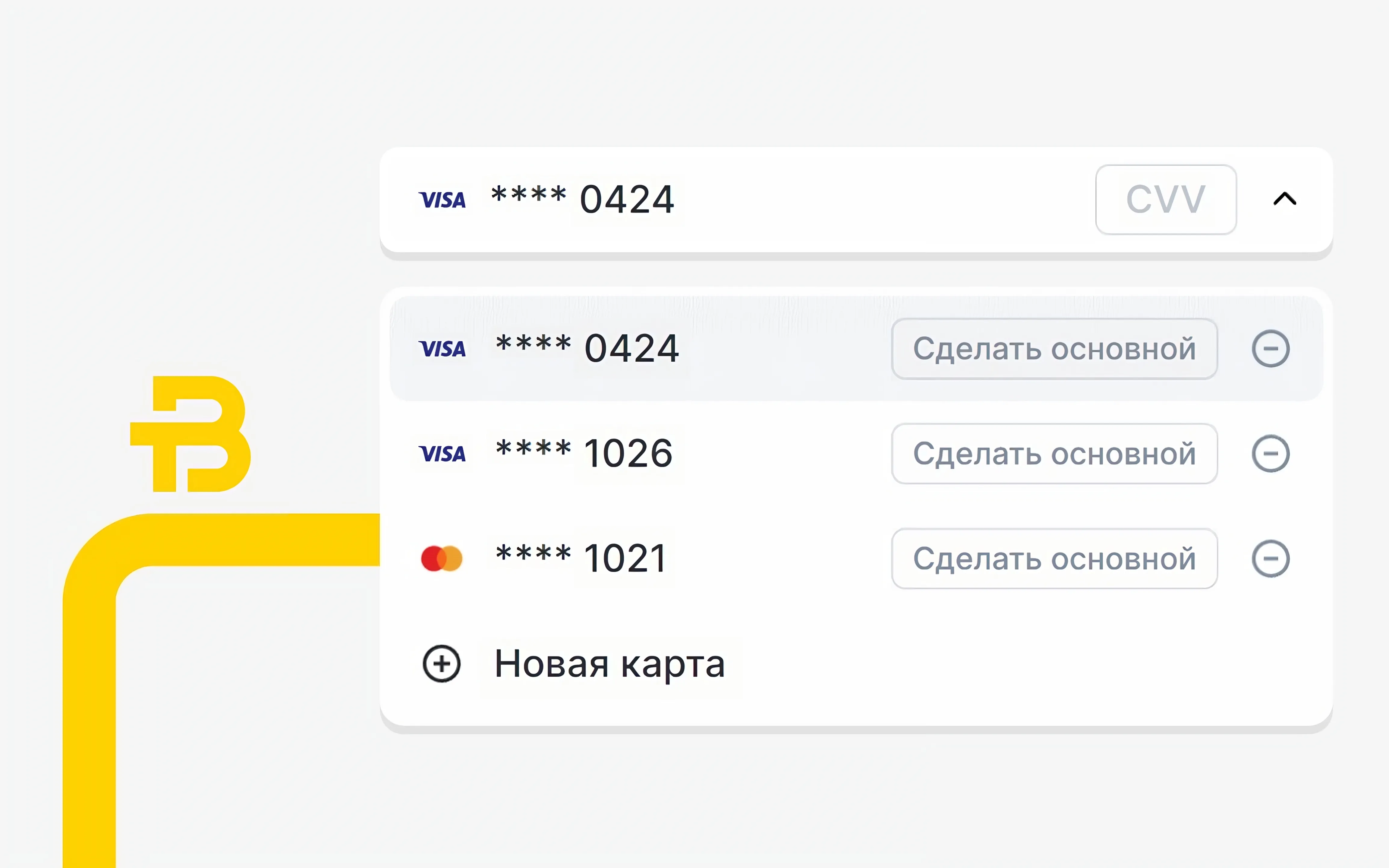

The web wallet is arguably the most convenient and the easiest of the different types of wallets to set up. There are several different websites or online platforms which offer this service and how it works is you just make your own account and it’s stored by the platform.

This is pretty much just like having a bank account. If you have an issue you bring it to them, it’s the web platform which will be hacked, and they almost certainly will have contingencies in place for that.

You can also access it at any time and anywhere you want. You don’t have to be at your computer, nor do you have to worry about a USB stick or some other external device which you are carrying around and trying to keep safe.

Should cryptocurrency reach its maximum potential, this will be the format through which most people will take advantage of it. It does seem to be the most logical, but again, cryptocurrency is new.

And as of right now it’s unclear how reliable the web platforms offering this service are. They’re not established in the same way that major banks are and so you’re opening yourself up to the possibility of scams if you go for this option.

If you really want to stay secure, the desktop wallet may be the best option for the time being and for the foreseeable future until the web wallets are more well-known and more regulated.

What you might want to do is have the desktop option as your primary wallet and some funds in a web wallet that you can use when on the go, but just enough for day-to-day living so that any potential loss won’t be too significant.

Другие новости

Больше новостей

- ∙ Новости компании

Новая акция для пользователей из Латвии: обменивайтесь без комиссий до конца года!

1 минуты

Всего один шаг

Узнать больше