Will Bitcoin Manage To Be Implemented Into Traditional Financial Models?

4 min

Even considering a notable drop in value right after 2021, Bitcoin has managed to keep performing well in the past few weeks. On February 22, BTC reached its highest yet price - $57k, but a few days later, the price has dropped again. Nevertheless, it seems that the currency will keep rising in price - today, March 8, 2021, at 11.00 UTC, the price is over 50k again.

BTC has closed at $48.758 on March 1, and now (March 8, 2021, at 11.00 UTC) it has managed to reach $50.125 - BTC has significantly raised in price just within a week. At first, the market-leading digital token reached a new record of $ 48,635 during the beginning of February after a massive $ 1.5 million (or £ 1.1 million) investment from the Tesla company owned by Elon Musk. This event has led to an increase in the price of Bitcoin even though after a while the costs have dropped.

But this past week, the cost of BTC has again increased in price, reaching 47-47 thousand dollars. It could be due to the rumors about a new partnership with MasterCard that has begun to spread. Today, on March 8, 2021, the cost of Bitcoin has reached 50k dollars again.

Bitcoin: Growth During The Past Year

Overall, the value of the token has risen more than 364% YOY (year on year). BTC keeps disrupting mainstream financial models which might even lead to the implementation of the coin into conventional financial models.

The main question is - will Bitcoin ever be accepted by these conventional financial models. Or rather it would stay as it is - simply a decentralized cryptocurrency, not accepted as a 'real' payment method?

Interestingly enough, instead of dropping in price and experiencing struggle during the 2020 pandemic (like nearly the rest of the world), BTC has shown a stellar performance. Bitcoin grew nearly 300% over the year and has managed to surpass the combined gains of gold and the Dow Jones Index by 10 times.

Some experts believe that Bitcoin is mirroring gold's momentum and trajectory during October 2020. Because of this interesting fact, some even speculate that Bitcoin has become (or already is) a safe way to invest during times of economic turmoil. Just like it was in the situation with gold.

The reason behind such an assumption is the way Bitcoin is operated. It seems that Bitcoin is a lot less affected by negative macroeconomic factors, especially if you compare it with other assets. For example, stocks and certain currencies definitely won't grant this lack of sensitivity since both are heavily affected by the overall economic situation.

Bitcoin, on the other hand, grants at least some level of stability. BTC allows it to avoid significant losses, while the traditional market might not be experiencing its best times during economic turmoils.

These peculiarities of Bitcoin have led to a situation when BTC is finally seen differently by investors and people overall. If in the nearest past it was considered as a speculative digital asset or simply an alternative to fiat money, today it is considered as the alternative to gold. Now investors see it as a safer investment method considering Bitcoin's relative stability.

Because of the overall situation with quarantine and covid-19, everyone understands the need for certain changes, especially when it comes to increasing the flexibility of financial systems. As a result, several well-known and popular fiscal companies are considering partnerships with Bitcoin and certain other altcoins. Supposedly, it should increase the security and scalability of certain payment options and solutions.

Will Bitcoin Be Able To Keep Growing?

Many critics of Bitcoin and the cryptocurrency concept overall claim that the whole situation with BTC is represented only by 12 years of growth. Moreover, two times out of three BTC has reached its highest price, which resulted in huge corrections in price. These price corrections have had a huge impact on the overall world of cryptocurrency.

The best example is the situation in 2018 after the market crash. Bitcoin had to shelve 50% of its value upon reaching its highest ever price during that time. It was the first time when Bitcoin has managed to break through the price of 20k dollars.

But other specialists note that today, Bitcoin is a lot more stable. It's a consistent digital asset and it is valuable in the eyes of investors considering that it is a safe store of wealth. Moreover, throughout the years of Bitcoin's existence, the blockchain has become more technologically developed.

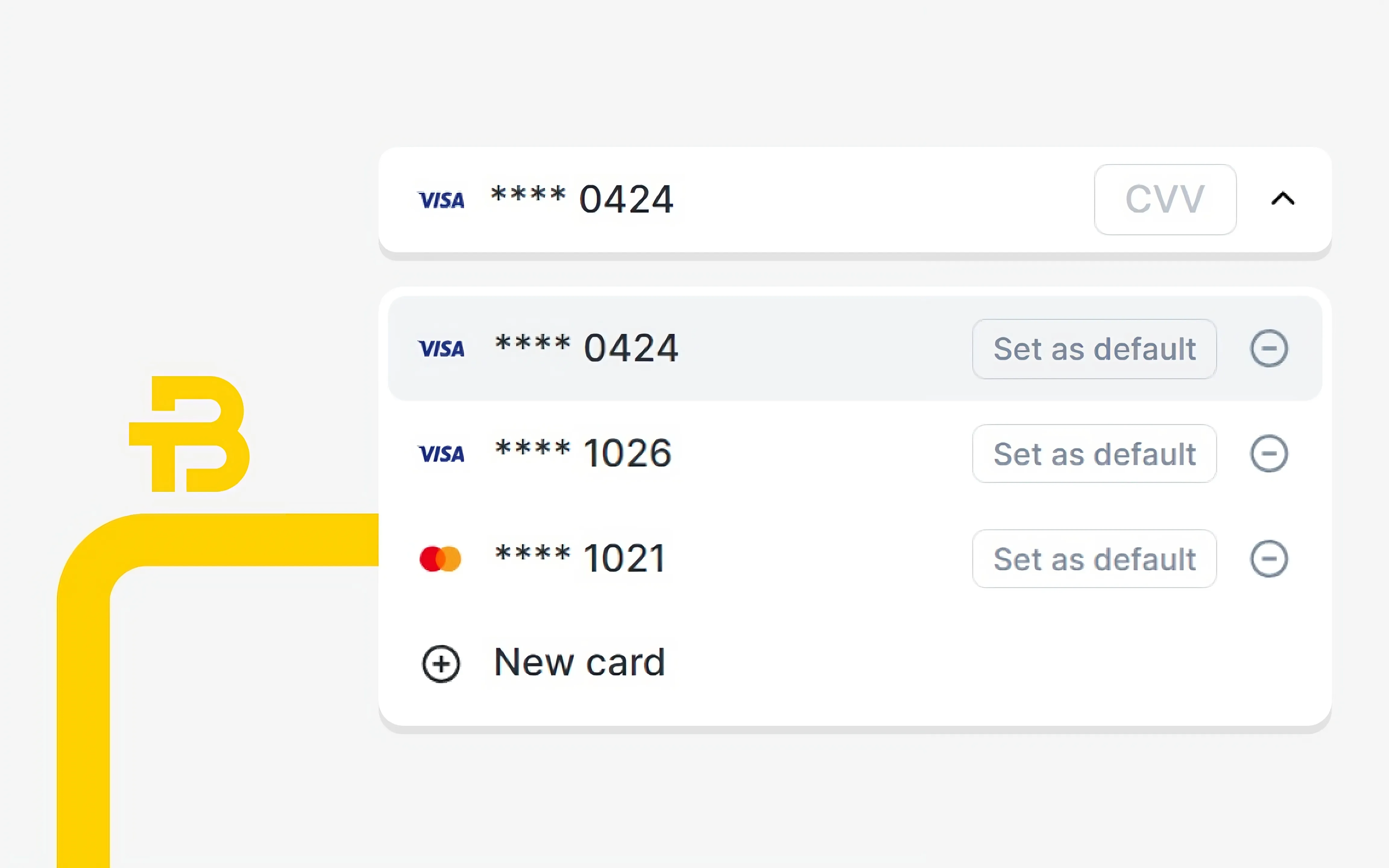

It's a secure system, which is why MasterCard may integrate Bitcoin into its payment system in the nearest future. Perhaps, it will even become possible in 2021. Considering all the mentioned factors, Bitcoin has become a more stable asset. That's why it could finally become a mainstream payment method in 2021.

Other news

More newsOne Single Step

Learn more