Best Low-Fee Cryptocurrency Exchanges in 2025

15 min

Crypto exchanges are the gateway to buying and selling digital assets like Bitcoin, Ethereum, and Solana, but not all platforms treat your money equally. For every enthusiastic investor chasing the next bull run, there’s an overlooked factor quietly chipping away at profits: trading fees. They might seem small on paper—fractions of a percent—but over time, those little percentages add up, especially for active traders or anyone building a serious portfolio.

That’s why choosing a low fee platform isn’t just a smart move—it’s a necessity. With hundreds of exchanges now operating globally, the competition has driven down costs while giving rise to wildly different pricing models. From maker/taker fee structures and gas fees to fiat conversion charges and deposit and withdrawal costs, knowing what you’re actually paying can be half the battle.

This article breaks down the lowest fee crypto exchanges of 2025, comparing their costs, features, and security. Whether you're buying your first coin or optimizing high-frequency trades, this guide helps you cut costs and protect your investments.

How Exchange Fees Work

Understanding crypto exchange fees is key to keeping your profits intact. Every platform builds its own pricing structure around how you trade, what you trade, and which currency you're depositing or withdrawing. But most fees fall into a few main categories — some obvious, some sneakier.

The most common fee model is the maker/taker fee system. When you place an order that adds liquidity to the market (a "maker"), you typically pay a lower fee than if you're removing liquidity with an instant trade (a "taker"). These rates can range from 0.01% to over 0.50%, depending on trading volume and platform policies.

If you're dealing with crypto wallets or moving funds around, you'll run into gas fees, especially on networks like Ethereum. These aren't charged by the exchange but by the blockchain itself and can spike during peak times.

Then there are deposit fees and withdrawal fees, which vary depending on the cryptocurrency or fiat conversion method you use. Credit card deposits often come with higher fees than bank transfers, while some platforms offer free crypto deposits but charge a flat network fee when withdrawing funds.

Fiat-to-crypto transactions are generally more expensive due to banking integration and liquidity challenges compared to crypto-to-crypto trades.

Common fee types include:

- Maker/taker fees based on order type

- Spread fees, the difference between buy and sell market prices

- Gas fees charged by blockchains like Ethereum or Solana

- Deposit fees depending on payment method

- Withdrawal fees that vary by asset

- Optional subscription fees for pro tools or premium support

Knowing what fees apply and where they come from helps you navigate even the lowest fee crypto exchanges more efficiently.

Top Cheapest Cryptocurrency Exchanges Reviews

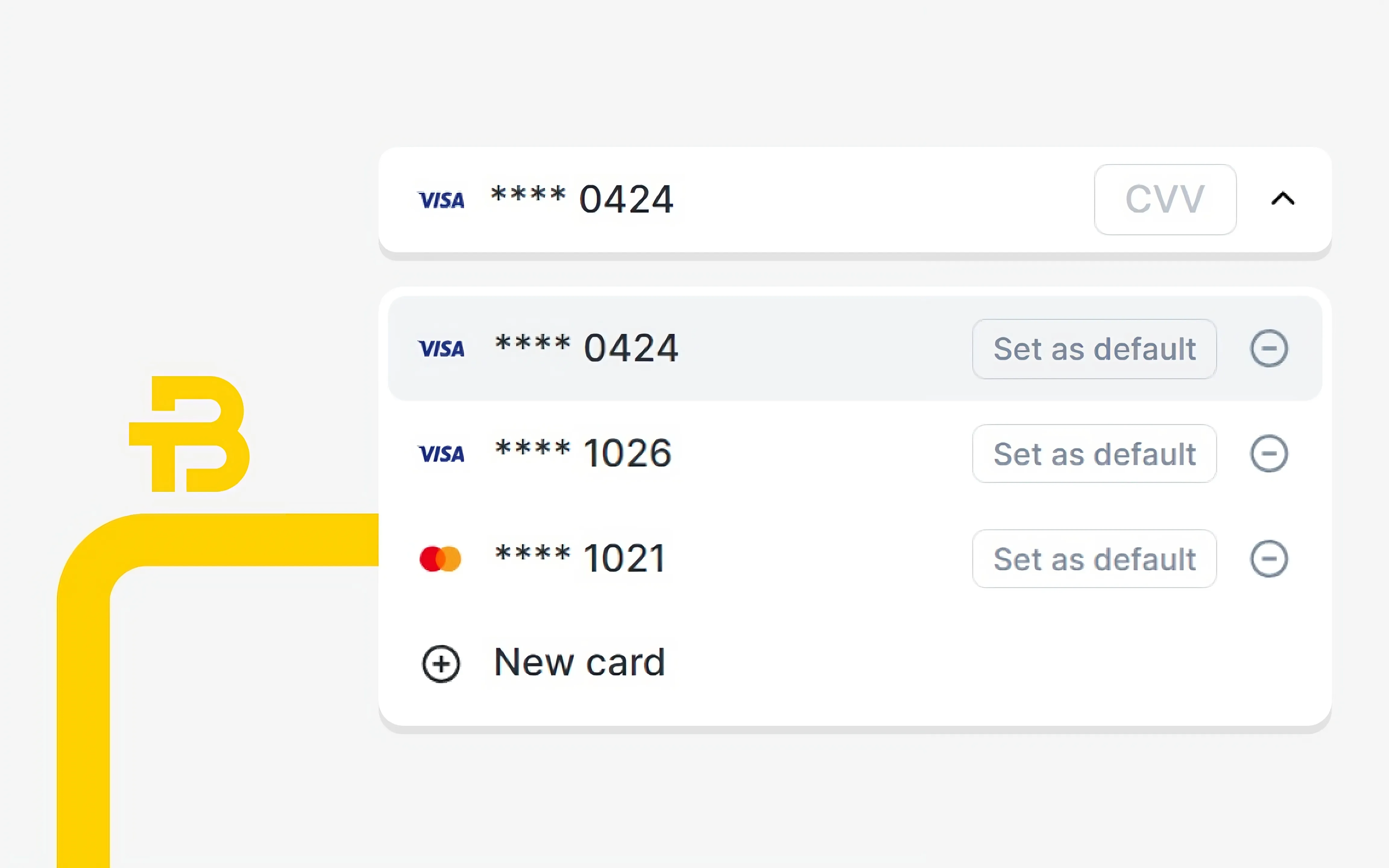

BTCBIT

BTCBIT is a regulated cryptocurrency exchange based in Europe, known for its focus on security, fiat accessibility, and user-friendly experience. The platform allows users to buy and sell Bitcoin, Ethereum, Tron, and other crypto assets using credit cards, bank transfers, and alternative payment methods. BTCBIT.NET isn’t built for advanced trading strategies but shines in areas like ease of access, compliance, and transparent verification.

It’s a solid option for those who prioritize security, regulatory compliance, and straightforward transactions, even if that comes at the cost of higher fees compared to platforms with tiered fee structures or high-frequency trading incentives. The platform is particularly well-suited for users new to crypto or those who want to enter the market with minimal friction and a high degree of trust.

Pros:

- Accepts major fiat currencies and multiple payment methods

- Strong emphasis on security measures (2FA, KYC)

- Reliable for crypto purchases with regulated infrastructure

- Ideal for beginners seeking a guided and safe experience

Cons:

- Charges a flat trading fee that is higher than most low fee crypto exchanges

- No advanced tools like margin trading or futures

- Limited native crypto-to-crypto trading pairs

- Customer support receives mixed user reviews

Kraken

Kraken is one of the most established names in the crypto space, known for its low fees and robust suite of advanced features. It operates two distinct platforms: the standard Kraken interface, ideal for beginners, and Kraken Pro, which caters to more experienced users with detailed charts, analytics, and order types.

Traders benefit from flexible tools like spot trading, margin trading, and futures trading, all supported by a tiered fee structure that rewards higher trading volumes. Professional trading features such as advanced API access and customizable dashboards make it popular among institutional users and active retail traders alike.

Pros:

- Extremely low fees on both spot and futures trading

- Offers margin trading with up to 5x leverage

- Two interfaces for different skill levels (main & Kraken Pro)

- Excellent security infrastructure and global compliance

Cons:

- Interface can feel complex for absolute beginners

- Limited fiat deposit methods in certain regions

- Slower customer support during periods of high demand

- Some trading pairs have lower liquidity than top-tier exchanges

Binance

Binance is the world’s largest cryptocurrency exchange by trading volume, and for good reason. Known for its competitive fees, vast asset selection, and extensive feature set, Binance offers a well-rounded experience for both beginners and professionals. Its tiered fee structure allows users to reduce trading costs further by paying with the BNB token, the exchange’s native asset.

Users have access to futures trading, spot markets, staking, lending, and even passive income products — all through a sleek, user-friendly interface available on both desktop and mobile. Binance’s high liquidity ensures efficient order execution across hundreds of trading pairs, making it attractive for high-volume and frequent traders.

Pros:

- Very competitive fees and fee reduction using BNB token

- Deep liquidity and hundreds of supported cryptocurrencies

- Offers futures trading, staking, lending, and more

- Highly scalable platform with global international presence

Cons:

- Regulatory restrictions in certain countries may limit access

- Complex interface may overwhelm first-time users

- Fiat onboarding can be limited depending on region

- Customer support can be inconsistent during market surges

Coinbase

Coinbase is one of the most recognizable cryptocurrency exchanges, especially among beginners. Known for its user-friendly interface and streamlined onboarding process, the platform is often the first stop for those entering the crypto space. It supports a wide range of digital assets, making it easy to build a diversified portfolio with just a few clicks.

Robust security measures are a top priority for Coinbase. The platform uses two-factor authentication, 98% cold storage for funds, and even offers FDIC insurance on USD balances (up to $250,000). These measures make it a strong choice for users concerned about asset safety. Coinbase also provides a comprehensive educational hub, helping users make informed trading decisions.

Pros:

- Extremely user-friendly interface, perfect for beginners

- Strong emphasis on security, including cold storage and FDIC insurance

- Wide range of supported digital assets

- High compliance standards and transparent operations

Cons:

- Trading fees are relatively high without using Coinbase Pro

- Recent SEC charges raise regulatory concern

- Limited advanced features like futures trading

- Fees can be confusing due to tiered pricing on different services

Bitstamp

Bitstamp is one of the oldest cryptocurrency exchanges in the world and has built a reputation around reliability, regulatory compliance, and transparent fee structures. It’s particularly popular among users looking for a more traditional, bank-like approach to crypto trading.

The platform offers spot trading for a focused range of digital assets including Bitcoin, Ethereum, and a handful of other major coins. It supports fiat currency deposits and withdrawals via bank transfer, credit card, and SEPA, making it convenient for European users. Crypto trading fees are competitive and based on a tiered system, rewarding higher monthly

Pros:

- Regulated and trusted crypto exchange with over a decade of operation

- One of the most transparent models among low fee crypto exchanges for higher-volume traders

- Supports fiat deposits via card and bank transfers

- High standards for security and legal compliance

Cons:

- Limited selection of digital assets and features

- No margin trading, staking, or advanced trading options

- User interface may feel outdated compared to newer platforms

- Slower deposit processing times in some regions

OKX

OKX has rapidly become a favorite among global traders thanks to its low fee crypto exchange structure, deep liquidity, and broad suite of advanced trading tools. The platform supports hundreds of digital assets across spot, margin trading, and futures trading markets, as well as options, perpetual swaps, and passive income products like staking and savings.

Its fee structure is among the most competitive, starting at just 0.08% for makers and 0.10% for takers — and even lower for VIP users or those who hold OKB, the platform’s native token. For high-frequency traders and institutions, OKX offers powerful APIs, detailed charting tools, and customized order types.

Pros:

- One of the lowest fee crypto exchange in the industry

- Advanced support for margin and futures trading

- High liquidity and large selection of trading pairs

- Offers passive income tools: staking, DeFi, and savings

Cons:

- Not available in the U.S. due to regulatory restrictions

- May overwhelm beginners with its professional-grade interface

- Some fiat deposit methods may require third-party services

- Customer service response time can vary

KuCoin

KuCoin is often called the “People’s Exchange” thanks to its wide access, low fee crypto exchange strucure, and support for lesser-known crypto assets. It's ideal for users seeking opportunities beyond the big names like Bitcoin, Ethereum, or Solana, offering exposure to hundreds of altcoins at early stages.

KuCoin's trading fee structure starts at 0.1% for both makers and takers, with fee discounts available through its native KCS token. The exchange also supports futures trading, margin trading, and passive income services like lending and soft staking — all through an interface that balances simplicity and depth.

Pros:

- Wide variety of crypto assets including many small-cap tokens

- Low fee crypto exchange with multiple fee reduction options

- Built-in tools for staking, lending, and passive income

- Excellent mobile app and clean user interface

Cons:

- Not licensed in some major jurisdictions

- Customer support can be inconsistent during busy periods

- History of past security breach, though resolved responsibly

- Fiat onboarding can be confusing for new users

How to Save on Exchange Fees

Reducing trading fees is one of the easiest ways to boost your net returns, especially for active traders. One key strategy is increasing your trading volumes — many platforms use tiered pricing that lowers fees as you trade more.

Using limit orders instead of market orders can also qualify you for “maker” pricing, which is typically cheaper. Almost every low fee crypto exchange also offers VIP programs that reward consistent users with personalized rates.

Safety Tips for Selecting Low-Fee Exchanges

Finding the low fee crypto exchanges is important, but not at the cost of security. Prioritize exchanges that use verified security protocols like two-factor authentication, cold storage, and encryption standards to protect your assets.

Top-tier platforms often hold SOC-2 certification and offer insurance to protect users against platform failures or hacks. These features add layers of confidence that your funds are safe — especially when storing large amounts of digital assets.

Always look for signs of regulatory compliance, especially if you're trading from regions with clear crypto laws. Platforms that adhere to financial standards are more likely to be accountable in the event of a dispute or security issue.

In short, the best low fee crypto exchanges aren’t just cheap — they’re secure, transparent, and built to last.

Decentralized vs Centralized Exchanges Fee Comparison

The growing popularity of decentralized exchanges (DEXs) has introduced a new dynamic in how traders approach costs. Unlike centralized exchanges (CEXs), which charge traditional maker/taker fees, DEXs often rely on smart contracts to facilitate trades between users directly. This removes intermediaries but introduces other costs.

On most DEXs, base trading fees fall between 0.1% and 0.5%. While these appear competitive, they don’t include gas fees, which are charged by blockchain networks like Ethereum. Depending on network congestion, these fees can surpass the actual trade amount, especially during high-volume periods.

Additional Exchange Fees and Costs

Beyond trading fees, crypto users face a range of additional expenses that can quietly eat into profits. These often vary by cryptocurrency, platform, and payment method.

Withdrawal fees differ significantly between coins — for example, withdrawing Bitcoin often costs more than Litecoin. Deposit fees are usually free for crypto, but fiat deposits via bank transfer or wire transfer may include processing charges.

Many platforms also charge network fees when moving assets between wallets or off the exchange. Others offer subscription lower fees for premium features — Coinbase One, for instance, offers zero-fee trading in exchange for a monthly rate, but this only makes sense if you're a frequent trader.

Common additional fees include:

- Withdrawal fees per coin

- Deposit fees for credit card or fiat transactions

- Network fees on blockchain transactions

- Subscription fees for premium access or tools

- Inactivity fees or low balance charges on some platforms

Being aware of these charges helps you evaluate the true cost of using even the lowest fee crypto exchange.

Tax Implications of Exchange Fees

When calculating tax obligations on crypto trades, fees play a crucial role in determining your final numbers. In many jurisdictions, cryptocurrency trading expenses — including exchange fees — can either be added to your cost basis when purchasing or subtracted from proceeds when selling.

This directly impacts your capital gains or losses, which are taxable events. If you earn profits, they become part of your taxable income, and accurate record-keeping ensures you're not overpaying on gains. Each fee, no matter how small, affects the bottom line.

Proper tax reporting requires detailed logs of transactions, including dates, asset types, values, and all associated fees. Many exchanges offer downloadable summaries or integrate with tax tools, but verifying those numbers manually is always smart, especially during audits.

How to Choose the Right Exchange

Picking the right crypto exchange isn’t just about low fees — it's about aligning the platform with your goals, experience level, and risk profile. Solid security measures, intuitive user interface, and responsive customer support should always rank high on your checklist.

Look for exchanges that offer broad asset support, competitive fee structures, and a range of payment methods that suit your preferences. If you plan to trade frequently, liquidity is crucial for fast execution and better pricing. For long-term holders, platform reliability and compliance matter more.

Key selection criteria include:

- Range of supported assets

- Available payment methods (card, bank, crypto)

- Platform security measures (2FA, cold storage)

- Overall user experience and interface design

- Depth of liquidity on preferred trading pairs

- Quality of customer support and help documentation

Account Setup and Verification Process

Creating a cryptocurrency exchange account typically starts with basic account creation using an email and password. Most platforms then guide you through a verification process to comply with KYC requirements. This usually includes identity verification via photo ID and sometimes proof of address.

The level of verification determines your trading limits and funding options. Basic accounts may allow small deposits and crypto-only trades, while full verification unlocks fiat support and higher daily withdrawal limits. Each exchange has slightly different requirements, but most follow global compliance standards to prevent fraud and money laundering.

Common Trading Strategies for Fee Optimization

To minimize trading fees, the most effective method is using limit orders instead of market orders, which helps avoid taker charges. High-frequency traders can benefit from volume discounts based on fee tiers tied to their monthly activity.

Smart portfolio management also helps — consolidating trades and avoiding unnecessary transfers reduces exposure to hidden fees. The goal is to strike a balance between trading frequency and execution efficiency without overpaying on each move. Over time, even small optimizations can make a noticeable difference in returns.

Future Trends in Exchange Fees

Fee trends across the crypto industry are shifting rapidly. As market competition increases, exchanges are lowering base rates and offering incentives to attract trading volumes. Many platforms now integrate tiered fee structures and promote zero fees trading for select pairs or VIP users.

Industry development and regulatory impact also play a role. As compliance costs rise, some exchanges may introduce new service fees, while others absorb them to stay competitive. Expect more transparency, customization, and smarter pricing models as the exchange landscape matures through 2025.

Conclusion

Choosing among the lowest fees crypto exchanges is essential for traders looking to protect their profits and scale efficiently. While dozens of platforms promise savings, only a few truly deliver consistent value across fee types, security, and performance. The best approach is to match your needs with low fee crypto exchanges that offers transparency, reliability, and responsive support. In 2025, reducing costs isn’t just a bonus — it’s a strategy.

FAQs

Who charges the least for crypto trades?

The lowest fee crypto exchange list includes BTCBIT, Kraken, and OKX. These platforms are preferred by active traders for their tiered discounts, native token perks, and efficient pricing models.

Which three exchanges lead the market?

BTCBIT.NET and Coinbase are known for robust user protection and regulatory compliance — even compared to other lowest fee crypto exchanges, their safety features remain industry benchmarks.

What’s the most secure crypto platform?

BTCBIT.NETand Coinbase are considered safest due to strong security features, regulatory compliance, and long-standing reputations, even among the lowest fees crypto exchanges available.

How does a crypto exchange operate?

A crypto exchange matches buy and sell orders through market-based algorithms. The best lowest fee crypto exchanges offer also optimizing for fast execution and liquidity across trading pairs.

What defines a good crypto exchange?

A strong platform offers low fees, deep liquidity, and clear support. The ideal lowest fee crypto exchange also minimizes hidden costs while maintaining reliability and user-focused features.

Which coin has the highest trust?

Bitcoin remains the most widely used and accepted digital currency on both lowest fee crypto exchanges and premium platforms, consistently leading in trading volume and global trust.

Other news

More newsOne Single Step

Learn more