Why is Bitcoin Halving so Important for Future Price Movement

5 dakika

As investors and enthusiasts, we’re always trying to predict the future of Bitcoin.

Time is ticking in the Bitcoin community, and Bitcoiners are preparing for the end of another 4-year cycle. It’s almost time for the next Bitcoin halving.

Today we’ll look at Bitcoin’s halving update and discuss the possible directions that it could take Bitcoin.

We’ll also investigate some speculations based on previous trends.

What is the Bitcoin Halving?

After a block is verified, miners receive a "block reward" in the form of Bitcoin and transaction fees. Initially, miners received 50 Bitcoin for verifying a block. That may seem like a lot, but remember, Bitcoin was virtually worthless shortly after its inception.

The Bitcoin halving is a network update that decreases the block reward miners receive for validating blocks, and takes effect once every 210,000 blocks.

After the first half, it dropped to 25. Now, the block reward is 12.5, and within the next 80 days (from the time of writing) it'll be 6.25 Bitcoins per block.

This major Bitcoin update doesn’t happen very often since an average Bitcoin block is verified every 10 minutes, or 144 per day. Only 21,000,000 bitcoins will ever exist, and the halving decreases the rate at which new Bitcoin is created.

After halving, the block reward will decrease, while also increasing the difficulty of mining bitcoin.

Eventually, all bitcoins will be mined, and miners will only make money from transaction fees.

Due to the basic laws of supply and demand, the smaller block reward will decrease the rate at which Bitcoin is created, despite a higher demand for the digital commodity.

The result?

Keep reading to find out.

When Will the Bitcoin Halving Happen?

The halving doesn’t happen on a specific day but rather every 210,000 blocks. However, since the network is on a distributed ledger, we can estimate that the next halving will occur around May 10th, 2020 according to this Bitcoin halving countdown from Buy Bitcoin Worldwide.

If 144 blocks were mined every day, then a Halving is likely to occur every 3.995 years or 1458 days.

How Will The Halving Affect Mining and Price?

When the halving occurs, and blocks get lowered from 12.5BTC to 6.25BTC, it’ll have a short-term negative effect on miners.

With the block’s reward dropping, miners will make less money and expend more energy as the difficulty level increases.

Some miners will be forced out of business. There may also be a short waiting time for transactions to get confirmed since there’ll still be a high demand for transactions, but a lower supply of miners.

The scary idea is that miners will sell all of their bitcoin to pay for future losses, dropping the price of Bitcoin. This Bitcoin drought could cause even more miners to go out of business.

Luckily, historic price trends tell a different story.

Previous Trends After Halving

Since the halving is so irregular, we’ve only seen two before.

The halving raises two questions:

How is it going to affect the miners?

And...

How will the price be affected?

Historically, the hash rate and Bitcoin price both have different movements right after a halving.

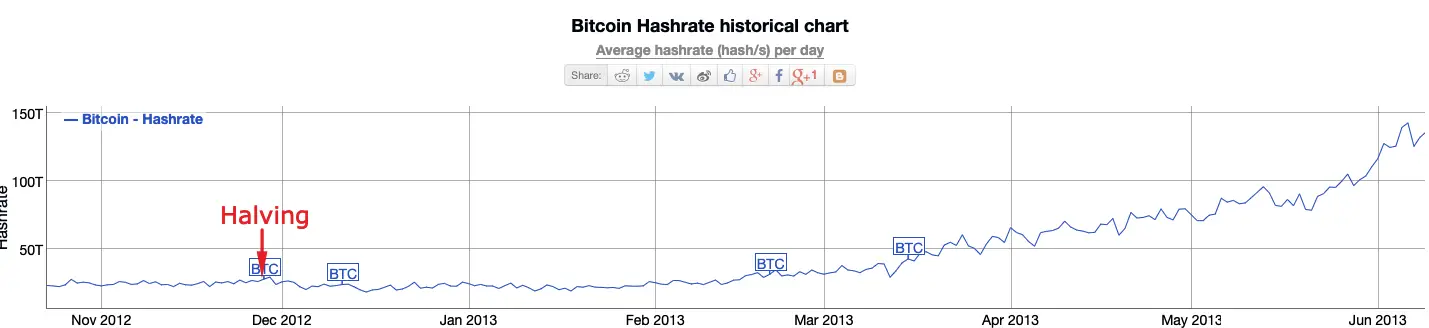

Hash Rate Trend:

2009: The rewards opened at 50 BTC per block.

November 28th, 2012: The mining reward is now 25BTC.

Within fourteen days of the halving, the Bitcoin network hash rate fell 7.63THash/s. This significant drop caused a network slowdown as seen during the network stabilization in March 2013 before a three-month pump.

Source: https://blockgeeks.com/guides/bitcoin-halving/

July 9, 2016: The mining reward is now 12.5BTC.

Source: https://blockgeeks.com/guides/bitcoin-halving/

Fast forward to the next halving, and we can see 0.16 EHash/s drop right after the halving. This decrease in hash started to pick up pace in December 2016 and continued to pump through May 2017.

In both scenarios, Bitcoin had a vast drop-in hash rate, which took about six months to completely normalize. So based on our historical knowledge, we can assume that this halving will have another negative effect on the hash-rate and take roughly six months to normalize.

After the hash rate drops, transactions will have a small delay and likely cause people to increase transaction fees, creating a mini spike in the average cost to send a timely transaction.

Price Change Trend:

Source: https://www.coindesk.com/litecoins-halving-is-months-away-but-traders-may-already-be-pricing-it-in

November 28, 2012: The halving was the start of a long bull run that brought Bitcoin to all-time highs (ATH). The price of Bitcoin was $12.25 and rose to $127 only 150 days later.

July 9, 2016: The halving started another long bull run that brought Bitcoin to a new ATH. The price of Bitcoin was $665 and rose to $758.81, only 150 days later.

If history were to repeat itself, that’d mean Bitcoin will increase 150 days out from the halving day. Investors seem incredibly interested in stocking up on Bitcoin before a halving due to the previous price increases.

With this upcoming halving, there are new aspects to the price that we have to take into consideration:

Bitcoin futures can now be purchased, whereas, in 2016, they could not. Bitcoin Futures can have a significant impact on the price of Bitcoin because the asset being bet on doesn’t need to be purchased, but instead, cash settlements are handled. In past halvings, the trading volume was much smaller, causing some people to underestimate the change of 12.5BTC to 6.25BTC since they were already experiencing high trading volume.

Conclusion

The halving is an essential part of Bitcoin’s protocol because it allows the asset to keep its deflationary attribute.

Without the halving protocol in place, every Bitcoin would likely have already been mined, causing the price to be significantly smaller due to the added supply.

Miners won’t be happy about the halving at first. However, if the price of Bitcoin does increase due to the cut in added supply, then miners and Bitcoiners will both benefit.

Diğer haberler

Daha fazla haber

- ∙ Company news

New Promo for Latvian Users: Enjoy Commission-Free Exchanges Until the End of the Year!

1 dakika

Tek Adımda

Daha fazla bilgi edinin