∙ Articles

Where to invest in 2019?

4 dakika

Investment is essential to securing the kind of future you want for yourself and your family. However, investment isn’t always as easy as it seems. There is a need to understand the possible opportunities for investment and how to make the most of them before investing.

With the right investment, you do not just protect yourself from any possible financial issues in the future, you also get to secure the kind of life you want even after you stop working. Also, you might also have some money you do not need now, the wise thing to do in this instance is investing this money so it grows over time.

There are several types of investments available. Therefore, it is important to find the one that suits you the most. From the safe investment options to the medium and high-risk options, you are sure to find something to invest in.

Considerations to Make Before Investment

The level of risk and time span are two important things to consider before investing. Most older investors are often conservative and therefore seek low-risk investments. This is also advisable for investors with short or intermediate goals.

However, younger investors tend to have more guts and as such opt for investment opportunities with higher risk profiles. If you’re looking to invest, here are some opportunities you might want to consider.

• Money market accounts

A money market account is a type of interest-bearing account that is insured by the FDIC. Money market accounts generally earn more than the typical savings accounts and might require higher minimum balances. This type of account is very good for emergency savings.

• Certificates of deposit

Certificates of Deposits are issued by banks. They also generally over higher interest rates than savings accounts. With a certificate of deposit, the bank pays you interest at regular intervals and upon maturation, you get back the original principal and interest. This type of investment is suitable for low-risk investors.

• Treasury securities

Treasury Bills are issued by governments to raise money for projects or to pay debts. T-bills are one of the safest investment options available. When they mature, the government pays the full value of the bill irrespective of how much you obtained them.

• Government bond funds

These are mutual funds also used by governments in debt securities. They include but are not limited to the use of T-bills, T-bond, mortgage-backed securities, etc. They are also well suited for low-risk investors

Investing in Cryptocurrency

Cryptocurrency is another investment option that is relatively new. Unlike some of the other traditional investment options, cryptocurrency is not handled by the government or banks.

Since the development of Bitcoin in 2009, several other cryptocurrencies have emerged and apart from their use in trade, these cryptocurrencies have also been shown to serve as an incredible investment option. Over the years, several investors have made huge profits from carefully exploring investment opportunities in cryptocurrency. However, just like other investment opportunities, investing in cryptocurrency also comes with a risk.

Although the world is still far from a complete transition to cryptocurrencies, the cryptocurrency investment space has been quite adventurous over the past few years. In the promotion and adoption of cryptocurrencies, a lot of individuals (and organizations in some instances) have offered individual coin offerings that can be likened to offering new stock. At the time, there wasn’t as much regulation of the process. This led to a valuation rate of almost $20,000 per coin in 2017. This has reduced since the time, however.

This attention-catching eye and fall of the value of Bitcoin, however, mad a lot of people interested in cryptocurrencies in general. Over the past few years, more regulatory procedures have been included in the cryptocurrencies. This has resulted in reduced risk and higher ROI in investing in cryptocurrencies.

Here are some important points to note when investing in cryptocurrency:

• Diversify your risk

Although most investors these days seek immediate returns when investing, this is not often the case. Investing in cryptocurrency requires an understanding of timing and trends. It is also important to diversify your risk. This can be achieved by using multiple verified platforms in cryptocurrencies. This way your risk is diversified.

• Consult Professionals

It is also important to consult financial professionals in cryptocurrency. These professionals can offer advice and make recommendations based on their knowledge and experience in the industry.

• Use Only Verified Platforms

Nowadays, there are a lot of platforms apps and websites when it comes to cryptocurrencies. Therefore, it is important to ensure that any apps and websites used in the course of your investment are verified.

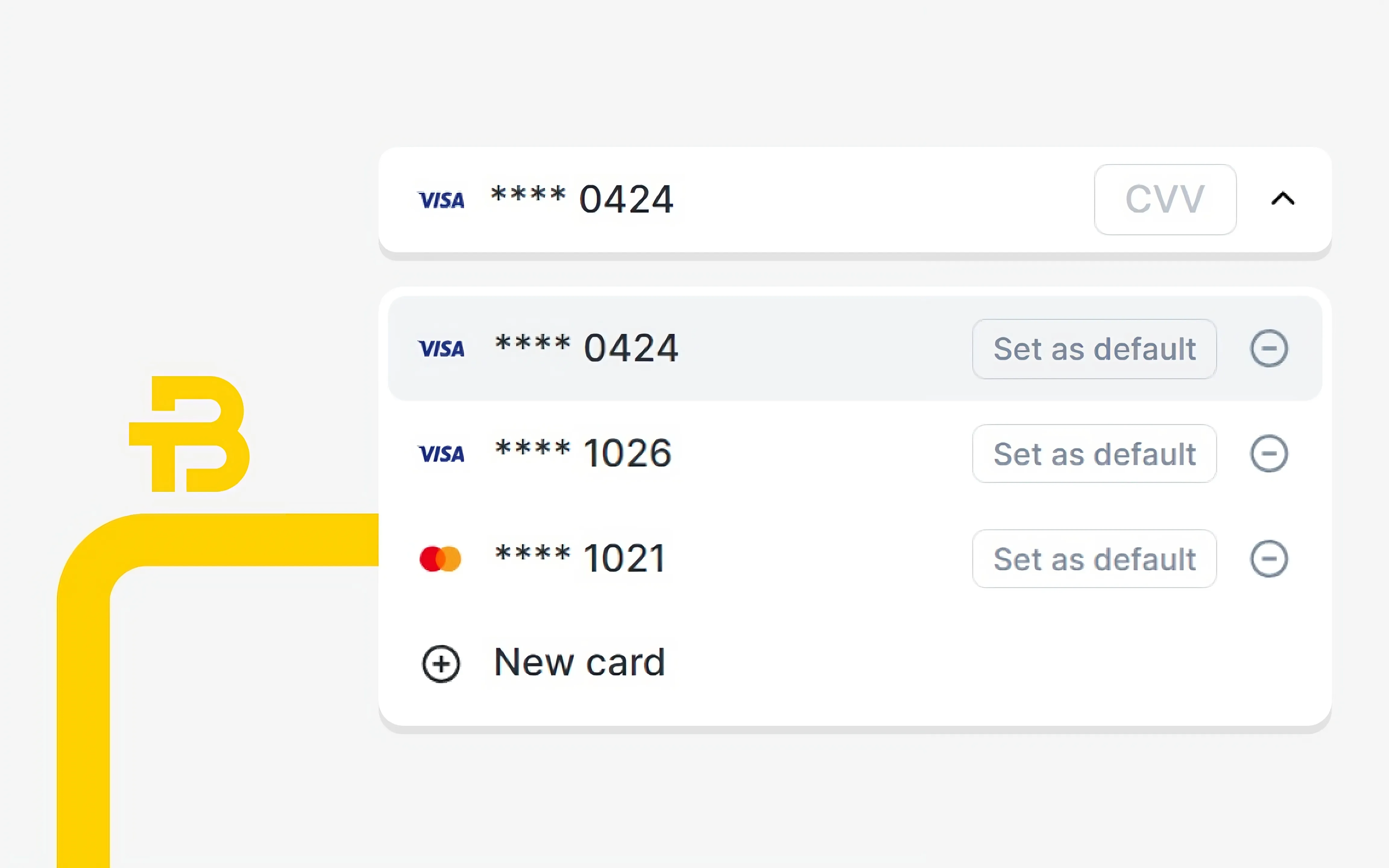

The investment option available in 2019 is now more than just the traditional investment options. You can now buy bitcoins with your credit card and get started in your investment journey.

There are several types of investments available. Therefore, it is important to find the one that suits you the most. From the safe investment options to the medium and high-risk options, you are sure to find something to invest in.

Considerations to Make Before Investment

The level of risk and time span are two important things to consider before investing. Most older investors are often conservative and therefore seek low-risk investments. This is also advisable for investors with short or intermediate goals.

However, younger investors tend to have more guts and as such opt for investment opportunities with higher risk profiles. If you’re looking to invest, here are some opportunities you might want to consider.

• Money market accounts

A money market account is a type of interest-bearing account that is insured by the FDIC. Money market accounts generally earn more than the typical savings accounts and might require higher minimum balances. This type of account is very good for emergency savings.

• Certificates of deposit

Certificates of Deposits are issued by banks. They also generally over higher interest rates than savings accounts. With a certificate of deposit, the bank pays you interest at regular intervals and upon maturation, you get back the original principal and interest. This type of investment is suitable for low-risk investors.

• Treasury securities

Treasury Bills are issued by governments to raise money for projects or to pay debts. T-bills are one of the safest investment options available. When they mature, the government pays the full value of the bill irrespective of how much you obtained them.

• Government bond funds

These are mutual funds also used by governments in debt securities. They include but are not limited to the use of T-bills, T-bond, mortgage-backed securities, etc. They are also well suited for low-risk investors

Investing in Cryptocurrency

Cryptocurrency is another investment option that is relatively new. Unlike some of the other traditional investment options, cryptocurrency is not handled by the government or banks.

Since the development of Bitcoin in 2009, several other cryptocurrencies have emerged and apart from their use in trade, these cryptocurrencies have also been shown to serve as an incredible investment option. Over the years, several investors have made huge profits from carefully exploring investment opportunities in cryptocurrency. However, just like other investment opportunities, investing in cryptocurrency also comes with a risk.

Although the world is still far from a complete transition to cryptocurrencies, the cryptocurrency investment space has been quite adventurous over the past few years. In the promotion and adoption of cryptocurrencies, a lot of individuals (and organizations in some instances) have offered individual coin offerings that can be likened to offering new stock. At the time, there wasn’t as much regulation of the process. This led to a valuation rate of almost $20,000 per coin in 2017. This has reduced since the time, however.

This attention-catching eye and fall of the value of Bitcoin, however, mad a lot of people interested in cryptocurrencies in general. Over the past few years, more regulatory procedures have been included in the cryptocurrencies. This has resulted in reduced risk and higher ROI in investing in cryptocurrencies.

Here are some important points to note when investing in cryptocurrency:

• Diversify your risk

Although most investors these days seek immediate returns when investing, this is not often the case. Investing in cryptocurrency requires an understanding of timing and trends. It is also important to diversify your risk. This can be achieved by using multiple verified platforms in cryptocurrencies. This way your risk is diversified.

• Consult Professionals

It is also important to consult financial professionals in cryptocurrency. These professionals can offer advice and make recommendations based on their knowledge and experience in the industry.

• Use Only Verified Platforms

Nowadays, there are a lot of platforms apps and websites when it comes to cryptocurrencies. Therefore, it is important to ensure that any apps and websites used in the course of your investment are verified.

The investment option available in 2019 is now more than just the traditional investment options. You can now buy bitcoins with your credit card and get started in your investment journey.

Diğer haberler

Daha fazla haber

- ∙ Company news

New Promo for Latvian Users: Enjoy Commission-Free Exchanges Until the End of the Year!

1 dakika

Tek Adımda

Daha fazla bilgi edinin

Kayıt

Sadece e-posta ve şifrenizi girmeniz yeterlidir, başka veri gerekmez. Anında kayıt.

**********